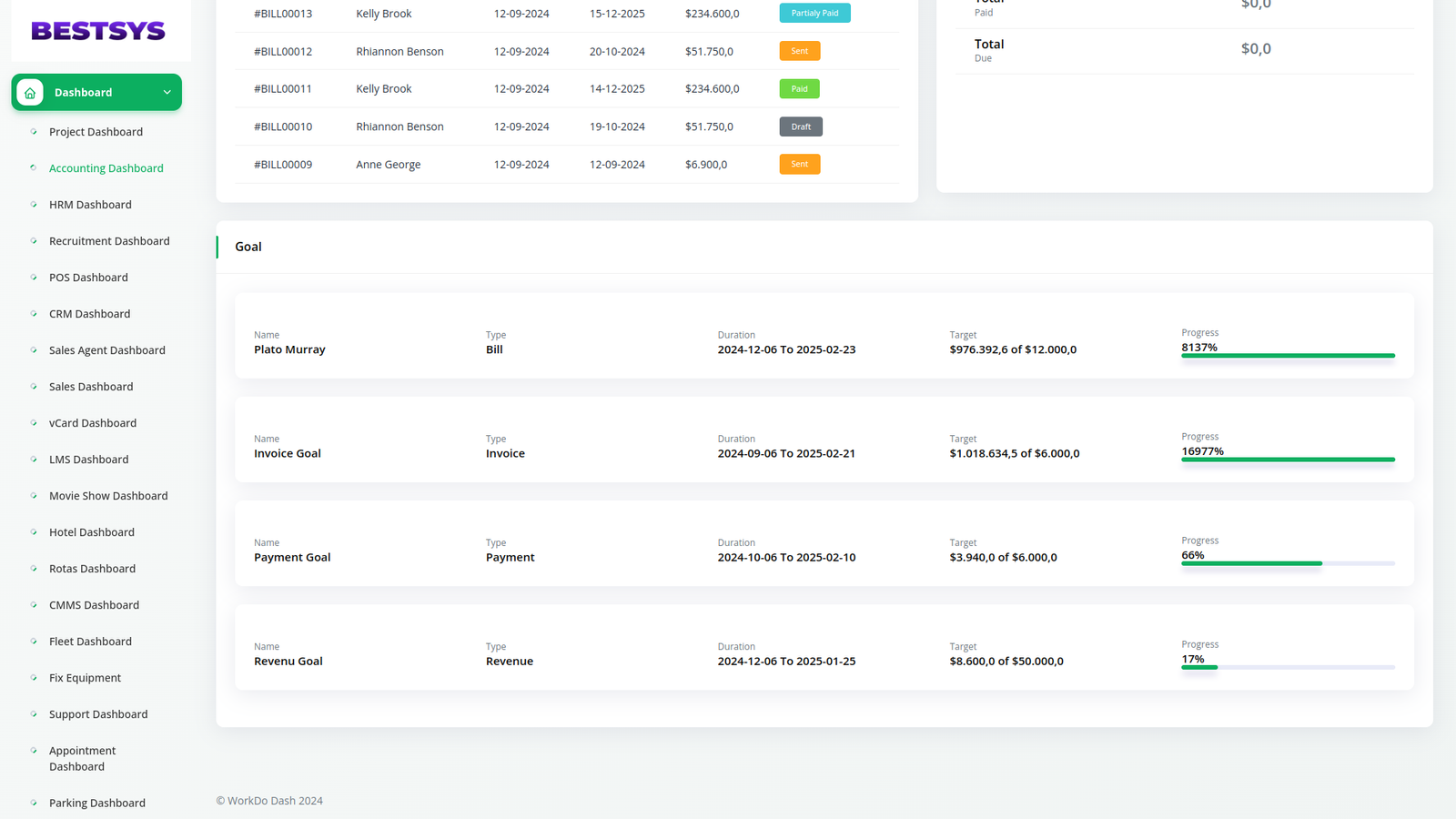

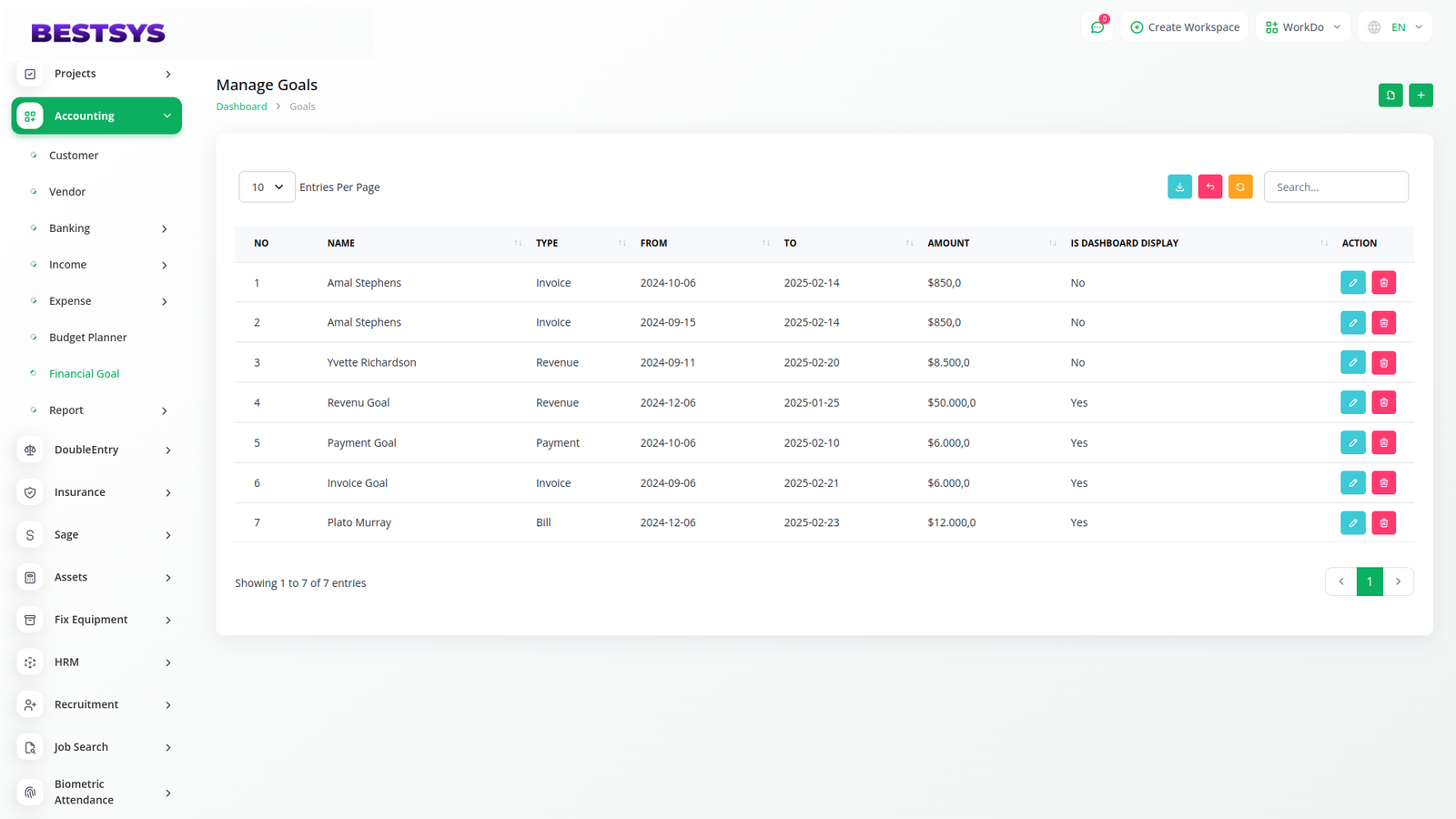

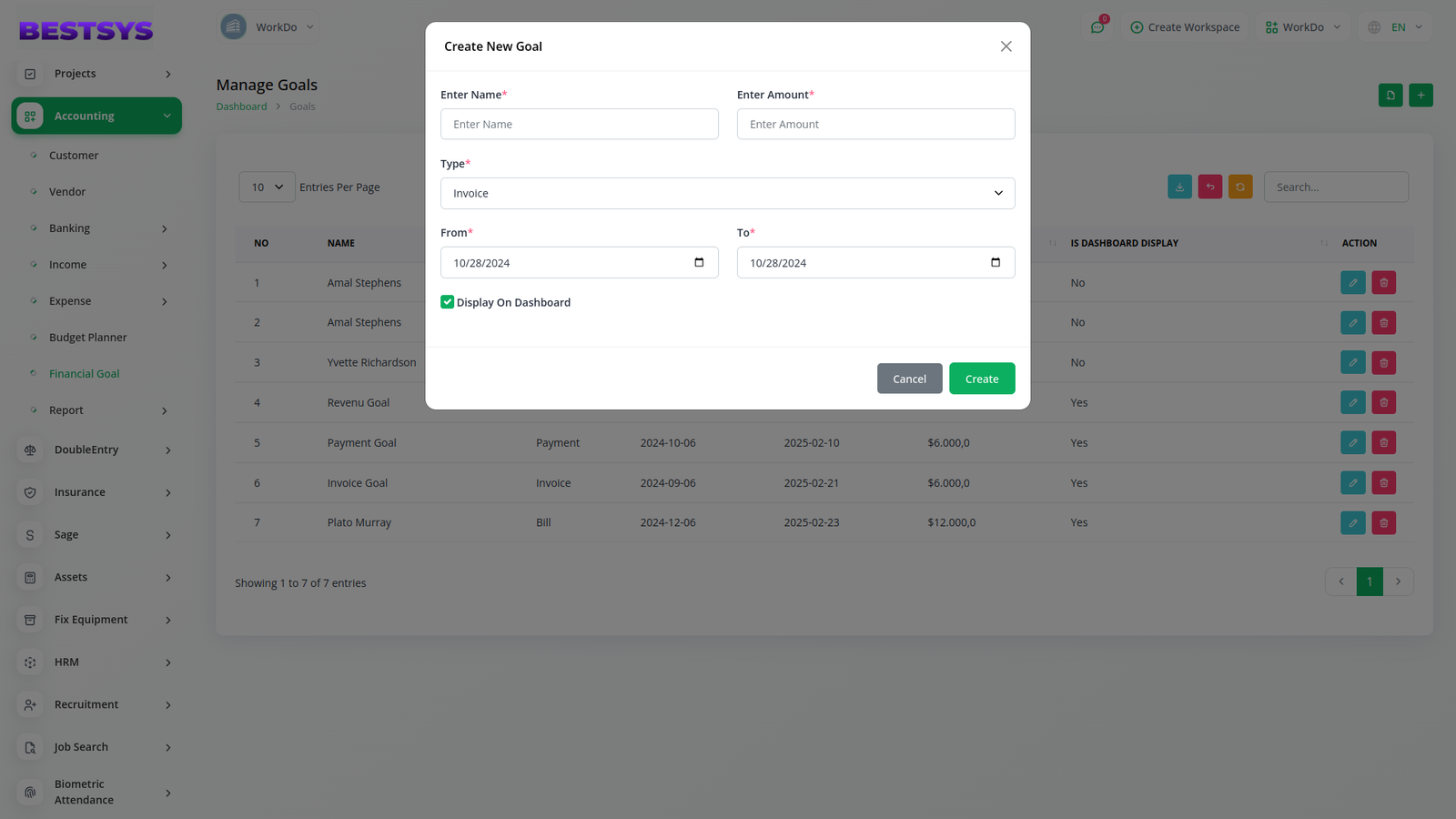

Financial Goal

Set and track your financial and business goals effortlessly. Monitor your progress, refine your strategy, and watch your business grow — all powered by the Account Module.

Financial Goals

A financial goal is a target to strive for when managing your money. It can include saving, spending, earning, or investing. Creating a clear list of financial goals is essential for building an effective budget.

What are financial goals?

Financial goals are the personal, big-picture objectives you set for how you plan to save and spend money. They can be short-term ambitions or long-term plans. Either way, identifying your goals ahead of time often makes it easier to achieve them.

As you start setting goals, consider what matters most to you. It’s perfectly normal to have multiple goals and for them to evolve over time.

Having financial goals can shape your future by guiding the choices you make today. For example, if your goal is to pay off a large credit card bill, you might reduce spending on takeout dinners and use those savings to make extra payments. Without a clear goal, it’s easy to keep spending as usual and let your debt grow.

Types of Financial Goals

While your goals can vary widely, it’s helpful to classify them within specific time frames to clarify your priorities. Categorizing goals by time frame allows you to visualize them better and pace yourself accordingly. To keep your life planned and on track, setting clear timelines is essential—this boosts your productivity and effectiveness. Here are the three main types of goals:

-

Short-Term Goals

-

Medium-Term Goals

-

Long-Term Goals

Why choose dedicated modulesfor Your Business?

With Bestsys, you can conveniently manage all your business functions from a single location.

Empower Your Workforce with BESTSYS

Access premium add-ons for Accounting, HR, Payments, Leads, Communication, Management, and more — all in one place with Bestsys!

- Pay-as-you-go

- Unlimited installation

- Secure cloud storage

Why choose dedicated modulesfor Your Business?

With Bestsys, you can conveniently manage all your business functions from a single location.